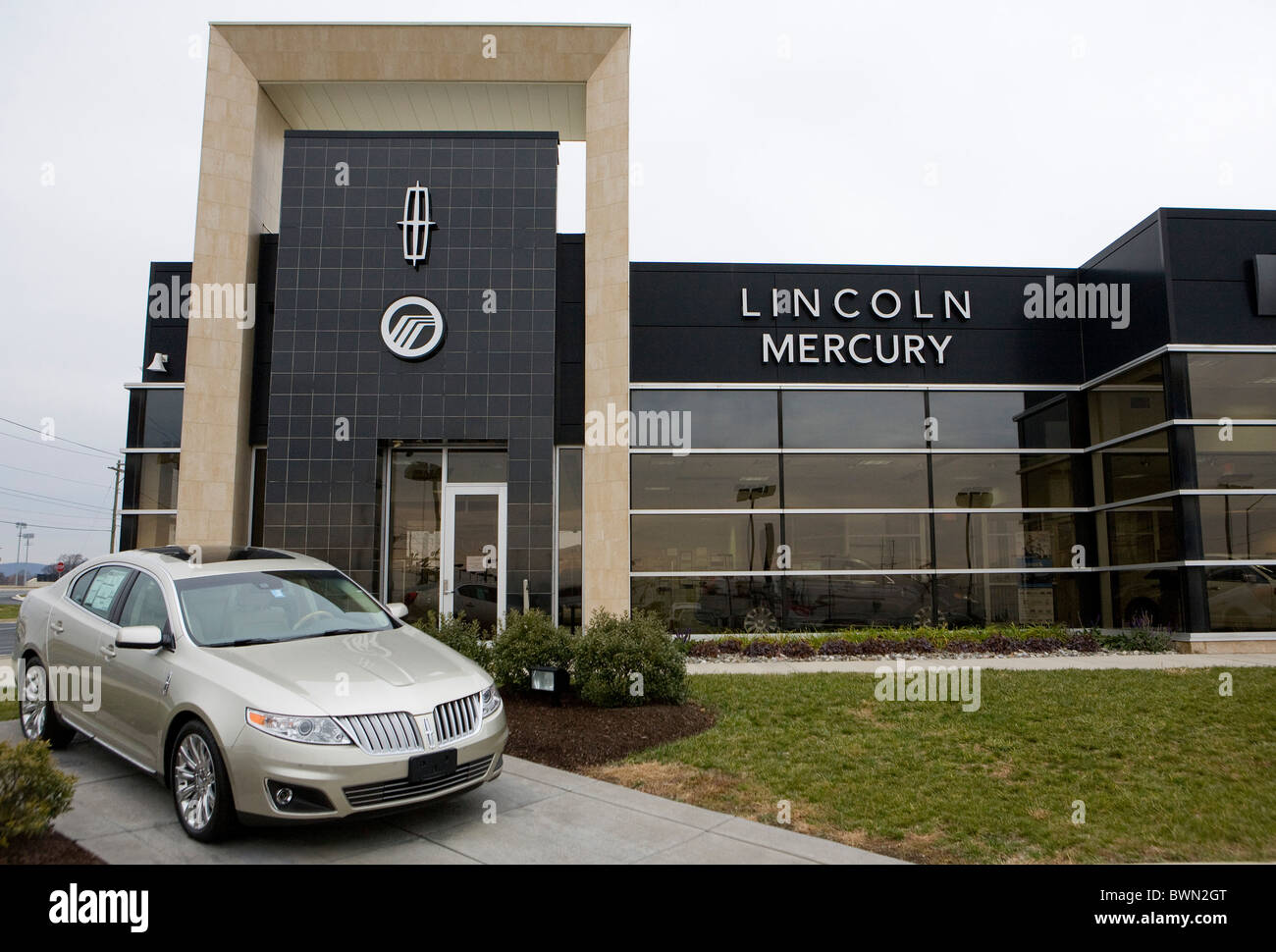

Check out the High-end of Lincoln Continental at Varsity Lincoln Dealerships

Wiki Article

In-depth Analysis of Auto Leasing Options: Finding the Perfect Fit

Navigating the landscape of cars and truck leasing can be an intricate endeavor, as the wide range of choices offered can frequently be frustrating. When thinking about a cars and truck lease, variables such as lease terms, end-of-lease choices, and the comparison between leasing and acquiring all play an essential function in making a notified decision. Discovering the optimal fit among this sea of choices calls for a thorough examination of various elements that affect the leasing procedure. By discovering the ins and outs of various leasing agreements and understanding how to negotiate favorable lease offers, one can lead the way towards a economically audio and satisfying leasing experience.

Sorts Of Automobile Leasing Agreements

The two key types of vehicle leasing arrangements are closed-end leases and open-end leases. Closed-end leases, likewise known as "walk-away leases," are the most typical kind of customer lease. In an open-end lease, the lessee is liable for any kind of difference between the residual value of the vehicle and its actual market value at the end of the lease term.Aspects Affecting Lease Terms

When entering right into a vehicle leasing arrangement,Comprehending the key aspects that influence lease terms is essential for individuals looking for to make enlightened choices. One vital aspect is the lorry's depreciation. The price at which an auto sheds value over time dramatically influences lease terms. Vehicles with lower devaluation rates often lead to more desirable lease terms. One more essential element is the lease term size. Shorter lease terms usually come with reduced rate of interest yet greater monthly repayments. On the various other hand, longer lease terms might have lower regular monthly payments yet can end up setting you back more as a result of building up rate of interest over time. The lessee's credit rating likewise plays a considerable function in determining lease terms. A greater credit rating can lead to lower interest rates and better lease problems. Furthermore, the discussed selling cost of the automobile, the cash aspect set by the renting company, and any type of down settlement or trade-in value can all affect the last lease terms provided to the person - lincoln dealers.

Recognizing Lease-End Options

What are the key factors to consider for lessees when it comes to evaluating their lease-end choices? As the lease term approaches its conclusion, lessees need to meticulously examine their lease-end options to make educated choices. One important consideration is comprehending the different choices available, such as returning the lorry, acquiring it outright, or discovering lease expansions. Evaluating the vehicle's current problem is additionally essential, as too much wear and tear or going beyond the gas mileage limit might sustain additional costs upon return. Lessees should acquaint themselves with any type of end-of-lease fees that might use and compare them to the expenses associated with acquiring the vehicle. Preparation ahead is important, and lessees ought to start discovering their choices well prior to the lease expiry date to avoid any type of final decisions. Additionally, thinking about future requirements and preferences can help in identifying whether to rent a brand-new lorry, expand the present lease, or choose for a different vehicle procurement method. By thoroughly assessing these variables, lessees can navigate their lease-end alternatives effectively and make the finest choice for their circumstances.Comparing Leasing Vs. Acquiring

Tips for Bargaining Lease Bargains

When negotiating lease deals for a vehicle, it is vital to completely study and understand the conditions and terms used by different dealerships. Start by identifying the kind of vehicle you require and how numerous miles you generally drive in a year. This info will certainly aid you bargain a lease with the proper mileage allowance to stay clear of excess gas mileage charges at the end of the lease term.Another idea is to ask about any kind of offered lease incentives, such as discounts or unique promotions, that can aid lower your regular monthly payments. Furthermore, take into consideration discussing the capitalized cost, which is the first cost of the vehicle prior to fees and tax obligations. Objective to decrease this cost with negotiation or by searching for vehicles with high residual worths, as this can result in extra appealing lease terms.

Additionally, carefully examine the lease contract for any type of covert fees or charges, and don't be reluctant to ask concerns or seek clarification on any kind of uncertain terms. By being ready and educated to bargain, you can protect a favorable lease deal that satisfies your needs and budget plan.

Verdict

To conclude, car leasing provides different options that can be customized to individual demands and choices. Comprehending the types of renting arrangements, factors affecting lease terms, and lease-end alternatives is crucial in making an educated choice. Comparing getting versus leasing can aid figure out one of the most cost-effective option. By working out lease deals efficiently, individuals can safeguard a beneficial agreement that suits their needs. Take into consideration all elements carefully to find the excellent fit for your vehicle leasing requirements.

When taking into consideration an automobile lease, variables such as lease terms, end-of-lease choices, and the comparison between leasing and purchasing all play a vital role in making a notified choice. Closed-end leases, likewise recognized as "walk-away leases," are the most typical type of consumer lease. In an open-end lease, the lessee is responsible for any kind of difference between the recurring value of the vehicle and its actual market value at the end of the lease term. In addition, lincoln dealers the negotiated selling price of the automobile, the money factor set by the leasing firm, and any type of down settlement or trade-in value can all influence the final lease terms used to the individual.

Understanding the kinds of leasing contracts, variables influencing lease terms, and lease-end alternatives is vital in making an educated decision.

Report this wiki page